Summary: Economic and political conditions have slowly evolved since the major nations began massive stimulus programs in early 2009. Now the pace may be accelerating. This post briefly looks at three major issues in the US (more coming later). As usual on the FM website, this states analysis and forecasts in clear language; the reader mentally can insert the necessary indications of uncertainty as needed.

Contents

- Foreclosure Fraud

- Trade and currency wars

- The mood of the American public: sliding into hysteria

(1) Foreclosure Fraud

Despite the oft-hysterical analysis, there is as yet insufficient public information about the scale of the problem. Quite likely even key players (e.g., banks, their law firms, government regulators) lack the necessary information. Deliberately, as all prefered to “see no evil.” But now that the problem has erupted into the daylight, this leaves them ill-prepared to respond. Especially as any adequate response will reveal their incompetence and malfeasance in creating the situation. (Here are Wells Fargo’s procedures regarding creditors’ complaints; nothing available for their procedures to debtors’ complains).

Political factors, not legal or economic, probably will control the evolution of this crisis. Hence the likelihood of modest impact to the national economy. More than the small impact expected by Wall Street; less than expected by the increasingly rabid doomsters. Over a longer horizon, a year or more, the economy will affect the political dynamics. For a good analysis of the current political situation see “Congress Taking Cautious Approach with Foreclosure Mess“, American Banker, 14 October 2010. The Republicans, as usual, eagerly support the banks — despite any violations of the law, despite the interests of the American people.

The economic impact looks to be minimal and probably less than the political effects. New home sales are unaffected by this crisis. The title problems are solvable. New home finance is unaffected, and in any case are now 90% government financed or guaranteed. Interruptions in sales of existing homes will have severe effects for those affected, but little for the overall economy (despite the massive attention to the volume of existing home sales, they have minimal economic effect).

What could change this forecast? A second dip would radically change the situation, as more links in US and global economy “unexpectedly” break. As would a long foreclosure moratorium, although this is unlikely under the current political regime. It could happen as part of system change, of such magnitude that the moratorium would be one of the lesser results.

Wall Street and news reports (will be updated) — not signs of major disruption so far:

- Foreclosures Gone Wild, Citi, 12 October 2010

- Foreclosure Moratorium Commentary, Doubleline, 14 October 2010 — Effects on the MBS market

- Pullbacks and Foreclosures: Fact vs Fiction, JP Morgan, 15 October 2010

- “Title Insurers to Lenders: Take Responsibility for Foreclosure Mess“, American Banker, 18 October 2010 — Another piece to resolving these problems falls into place, despite the doomsters’ forecast. Free registration required.

- “Pimco, NY Fed Said to Seek BofA Repurchase of Mortgages“, Bloomberg, 19 October 2010 — The big event in this crisis, giant institutions struggling to avoid losses.

- “Fidelity National to Require Banks to Sign Foreclosure Warranty“, Bloomberg, 20 October 2010

- “Sarbanes-Oxley May Expose Bank Execs to Suits in Foreclosure Doc Mess“, American Banker, 20 October 2010

- “Title insurers drop demands on mortgage lenders in foreclosure cases“, Wasington Post, 28 October 2010

For more about this see

- Consequences of a long, deep recession – about foreclosure moritoriums

- A briefing about the foreclosure fraud crisis: its origin and impacts.

(2) Trade and currency wars

The news media are agog with talk of trade or currency “wars”, no matter how unlikely. Central bankers know that such open conflict would have no winners, leaving everybody worse off. Among other things, such conflict implies high odds of a crash in the US dollar, Japan’s political and economic regime, and probably other major failures in the global finance and political machinery.

During the financial crisis central banks have poorly coordinated their efforts, but have avoided outright conflict. Doing so would have disasterous consequences, easily sliding into very ugly scenarios. This becomes more likely should global growth again slide to near-zero (global real GDP growth below 2%/year is a considered a recession).

But — the focus on currencies is correct, as they are the primary fault lines in the foundation of the global economic regime. The system no longer functions well, and both growth and recession will further destabilze the global economy. Our inability to change the world’s currency regime is our equivalent of the golden fetters of the 1930s — fetters of the mind preventing us from taking necessary action.

For more about this see:

- A brief note on the US Dollar. Is this like August 1914?, 8 November 2007 — How the current situation is as unstable financially as was Europe geopolitically in early 1914.

- Geopolitical implications of the current economic downturn, 24 January 2008 – How will this recession end? With re-balancing of the global economy — and a decline of the US dollar so that the US goods and services are again competitive. No more trade deficit, and we can pay our debts.

- What will America look like after this recession?, 18 March 2008 — The recession will change many things, from the distribution of wealth within the US to the ranking of global powers.

- Fetters of the mind blind us so that we cannot see a solution to this crisis, 1 April 2009 — About the fetters, although they’re yet invisible.

- The falling US dollar – bane or boon?, 14 October 2009

- We’re still blinded by our fetters of the mind and so unable to fix the economic crisis, 13 September 2010 — Now we can see them, binding our minds.

(3) The mood of the American public: sliding into hysteria

Hysteria is building in the US, affecting all pubic issues. Climate change, Islamic jihadist, foreclosure fraud, the Fed’s next monetary stimulus program (QE2) — all increasingly discussed by true believers in apocalyptic terms, who treat sceptics with scorn. These are all largely American obsessions, discussed elsewhere in relatively moderate terms — as problems deserving policy responses, not existential threats. All serve to divert attention from our serious social problems — such as the increasing inequality of income and wealth, the destruction of our middle class, aging of our physical infrastructure, and imbalanced national finances (i.e., government debt and deficits, structural trade deficits), and bankrupt retirement systems.

These bouts of hysteria in the US have been carefully built, as our elites have learned that a fearful people is an easily led people.

“Mr. President, if that’s what you want there is only one way to get it. That is to make a personal appearance before Congress and scare the hell out of the country.”

— Senator Arthur Vandenberg’s advice to Truman about how to start the Cold War. On 12 March 1947 Truman did exactly that. From Put yourself in Marshall’s place, James P. Warburg (1948); in 1941 Warburg helped develop our wartime propaganda programs.

For example, see the growing hysteria about QE2 causing hyperinflation. Carefully stoked by conservatives who believe “the worse, the better” (see Republicans have found a sure-fire path to victory in the November elections). It’s almost without analytical foundation, as deflation threatens to burn the debt-heavy US economy to its foundation — and the Fed’s slow implementation of QE2 more likely to have too-small effects than excessively large ones. This hysteria could still have disruptive effects if spreads. The Street discounts this possibility. But crying “fire” in a crowded theater can have big ill effects even without a fire.

The extent and magnitude of this hysteria cannot be easily measured. The growth of the almost-irrational Tea Party Movement suggests we’re rapidly sliding downhill. History shows that hysteria is contagious, especially in societies under stress. Like America, with 5 million homes either in extended default (90+ days) or foreclosure. And over 30 million people fired over the past 12 months, from a 140 million person work force. Most find jobs, but at lower benefits, wage rate, or hours.

I believe our elites have no idea of the growing stress among the American people. Provoking hysteria often works well for elites. Until it creates severe backblast. But hysteria never helps us clearly see events, choose among available paths, and execute our decisions.

For more about this see It’s a national emergency, so an opportunity to watch much of America get hysterical.

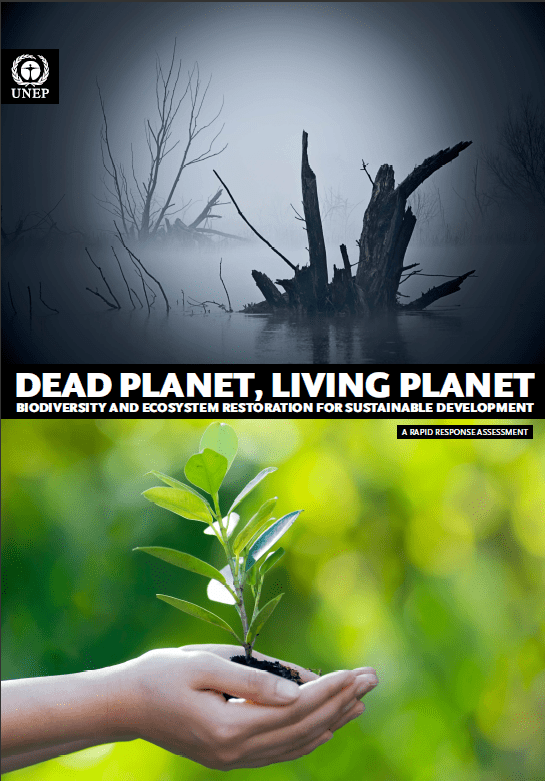

Update: A nice example of an attempt to induce hysteria: “Dead planet, living planet: Biodiversity and ecosystem restoration for sustainable development“, United Nations, June 2010 — The report is reasonable; the cover over-the-top.

Please this outrageous news about another dimension of mortgage fraud by bankers: “Ties to Insurers Could Land Mortgage Servicers in More Trouble“, American Banker, 10 November 2010 — Opening: